Property Purchase

Property Purchase Structure Requirement for the SMSF:

An SMSF with a corporate trustee is most common and recommended structure for buying a property in the SMSF. We can help you establish both structures in 1-2 days.

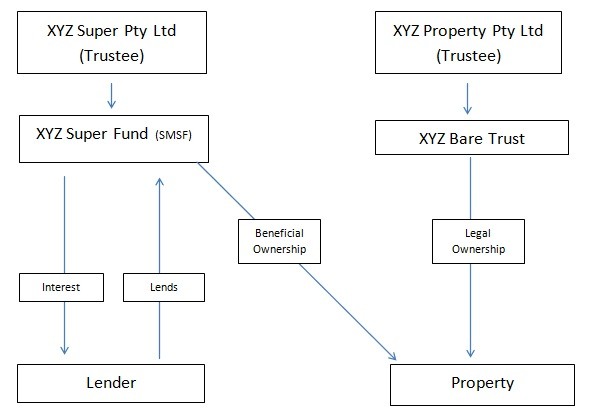

A typical Structure of the SMSF borrowing:

Step by step for property purchase in the SMSF:

To comply with the borrowing rules, the trustees of the SMSF can follow the steps below to purchase the property in the SMSF:

1. Check the trust deed and investment strategy:

It is to ensure the borrowing and property investment is allowed in the fund. Update the trust deed and investment strategy if necessary. For all iCare Super clients, this will done by our specialised team to ensure all the legal documents are up to date before the purchase.

2. Find the property that the SMSF will buy:

The trustees of the SMSF should find a suitable property for the SMSF and advise us of the address and property details.

3. Apply for loan pre-approval:

You need to talk to the lenders to see if you can satisfy their lending criterion. There are so many lenders on the market and we allow you to borrow form any lenders. So it is your choice to get the best deal for your SMSF.

Most of external lenders have a maximum loan to valuation ratio (LVR) 70-75% and require guarantees from the members/trustees in their personal capacity. The banks may require the trustee to provide information, like superannuation contributions, proposed rent and other income, to ensure the repayments can be made.

4. Pay Deposit to the Vendor:

The trustee of the SMSF may be required pay a deposit to the Vendor or vendor’s agent (normally 10% of purchase price) for the underlying property. Please be noted that the receipt of the money should have the name of the trustee of the SMSF as the purchaser.

5. Establish corporate trustee for the custodian/bare trust:

The company can have one or all the members of the SMSF as directors / shareholders. This company can be the trustee for multiple custodian/bare trusts.

The corporate trustee of the SMSF cannot also act as trustee of the custodian/bare trust. So you will have two separate companies if the trustee of the SMSF is a company.

For the corporate trustee of the custodian/bare trust, we recommend setting up a is a newly established company or has never traded before –it’s only purpose is to hold the asset in trust for the trustee of the SMSF.

Note this company is not a “Special purpose company”, which means that this company will pay normal Annual ASIC Review Fee each year. There is no need for this company to have a tax file number, ABN or a bank account etc.

6. Establish the custodian/bare trust:

The custodian/bare trust will be established by the trust deed. The property address has to be embedded in all documents including Property Custodian Trust deed (PCT deed) and related legal documents.

Note that the trust deed must be stamped with State Revenue Office before transfer of property. Amount of Stamp duty depends on the state laws where the deed is executed. These requirements change from time to time; hence it is advisable to check with your local office.

7. Purchase the property:

The buyer of the property on the purchase contract document MUST be the name of “trustee of the custodian/bare trust”. You need to ensure that <name of the trustee of the custodian/bare trust> appears on the transfer records and not the <name of trustee of SMSF>.

8. Loan Approved by the lender:

The lenders will send you the confirmation for the final loan approval and you can sign and return them as instructed.

9. Property settlement:

At the time of settlement – the bank lender pays the amount lent directly to the vendor on instructions from the trustee of the SMSF and trustee of the custodian/bare trust. The SMSF pays the balance amount to the vendor and other related costs such stamp duty, legal fees etc. via bank cheques as instructed by the solicitor or conveyancer.

And now you can enjoy the benefit of borrowing in your SMSF!